Organic Cotton Potential

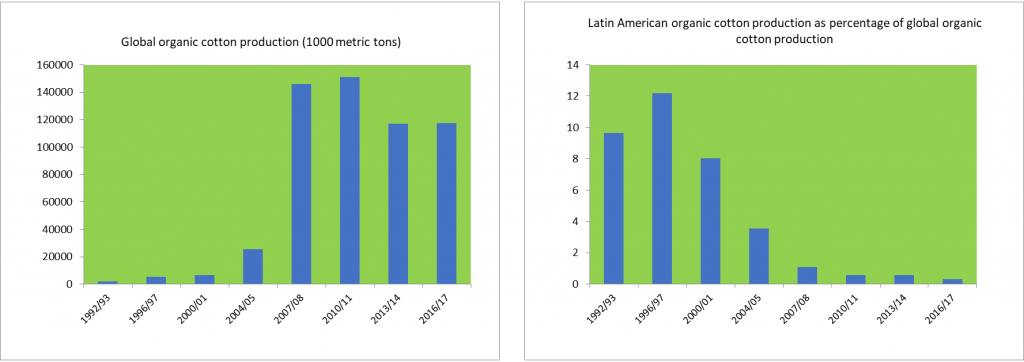

Within the last 20 years global organic cotton production increased from 5.507 tons/year (season 1996/97) to 118.000 tons/year (season 2016/17), i.e. at an average rate of 14,19 %/year. Latin America’s contribution to global organic cotton production during that period, however, decreased from 671 to 381 tons/year, and therewith fell from 12,2 % of global organic cotton output, to a rather insignificant 0,3 % of global output (Production of Organic Cotton in Latin America and Comparison with World Production, A. Grisar, October 2018). There are, however, no good reasons why organic cotton production has not increased in Latin America at the rate it has globally. Many Latin American countries have been traditional cotton producers and exporters, soil and climatic conditions are excellent, and most of the countries have a well-established textile industry and competitive fashion and confectioning sectors. Moreover, there is in the region much experience with cutting, sewing and trimming (CST) with material and yarn brought from the US, particularly in Central America.

Generally, competition on apparel and home textiles has been tough throughout the world during the last 20 years and cotton and textile production has been declining in most Latin American countries. To recover lost production it seems, however, advisable not to look into mass markets, where prices are the most decisive criteria, but to look into promising niche markets.

Organic cotton products present such a niche market.

The market value trend diagram of the 2014 Organic Cotton Market Report of Textile Exchange shows that consumption of products made of organic cotton has globally increased by 67% between the seasons 2012/13 and 2013/14, and reached 15,7 billion US$.

The market value trend diagram of the 2014 Organic Cotton Market Report of Textile Exchange shows that consumption of products made of organic cotton has globally increased by 67% between the seasons 2012/13 and 2013/14, and reached 15,7 billion US$.

31,5% of it, i.e. 4,9 billion US$ correspond to the American market, a figure which certainly should call the attention of all enterprises of the cotton value chain in Central and South America, cotton growers and ginners, spinning mills, dyeing and weaving factories, cutting and sewing units alike, especially the entire fashion sector of the region and its trend setting brands.

Though there are certain tendencies to produce organic cotton products with imported raw materials (like it is done already in Peru, Colombia and El Salvador), it seems out of question that the producers which can rely on local organic cotton will on the long run have a tremendous competitive advantage.

Potential versus reality

What made Latin America not to follow global trends? There might be some historical justifications for some particular countries for it, but actually no convincing explanation for the fact that organic cotton cultivation did not grow in the entire region. Moreover there are no reasons the trend couldn’t be reversed in future.

Latin America’s cotton dilemma – frightening facts

Nicaragua cultivated cotton on up to 200.000 ha in the seventies and is cultivating only on 2.000 ha nowadays.

In the Choluteca Valley in Honduras cotton cultivation was terminated because the Choluteca River carried pesticides up to its mouth into the Pacific, there killing the shrimps of the coastal breeders. Terminating cotton cropping could, however, be avoided by switching to organic cropping. Moreover, organic cotton seed could have been used as shrimp food, therewith converting the farms to produce organic shrimps in view of its attractive premium price.

In the Choluteca Valley in Honduras cotton cultivation was terminated because the Choluteca River carried pesticides up to its mouth into the Pacific, there killing the shrimps of the coastal breeders. Terminating cotton cropping could, however, be avoided by switching to organic cropping. Moreover, organic cotton seed could have been used as shrimp food, therewith converting the farms to produce organic shrimps in view of its attractive premium price.

No cotton at all is these days cultivated in El Salvador, though 100.000 ha of land of the rather small country were dedicated to cotton in the seventies.

In Mexico during that same period cotton fields decreased from a total of 500.000 ha to 150.000 ha.

A similar decrease was registered in Colombia: from 300.000 ha in the seventies to presently 10.000 ha.

A similar decrease was registered in Colombia: from 300.000 ha in the seventies to presently 10.000 ha.

In Colombia’s industrial centre, Medellín, the tallest buildings were once all owned by the biggest textile mills. No longer: most textile enterprises have suffered serious crises and nowadays the bulk of the country’s apparel requirements are imported from the Far East, and 60-70% of the cotton requirements of the country’s still remaining textile mills is imported from the US.

52 years of war in the country led to mistrust and a lack of communication within the cotton value chain. Colombia is now, however, ready to counteract these failures.

Many countries of the region once had a strong textile industry and well developed design, fashion and confectioning sectors, i.e. ideal conditions for empowering the entire value chain. However, this did not happen. Instead, some countries, especially in Central America, are just in the business of cutting and sewing for American brands based on imported yarn and material from the US.

Much lower labour costs in Latin American countries as compared to those in the US led to such schemes (‘maquillaje’). Moreover in view of lead time advantages (3-5 weeks as compared to Far East producers), an aspect which is becoming more and more important, especially to the fast fashion sector, American brands increasingly tend to search for sourcing possibilities in the continent. The government of Honduras, for instance, plans to create 200.000 new jobs (more than double its present textile work force) until 2020 by incentivising the sector (Firmas internacionales interesadas en invertir en Honduras).

However, the advantages of vicinity (ease of communication and control, shorter lead times, low labour costs) do equally apply to fibre production, ginning, spinning, dying and weaving, and there are actually no determining reasons why these processes should not be done in Latin American countries, especially in those of favourable cotton cropping conditions.

Organic cotton production requires considerably more labour (manual weeding and harvesting) than conventional cotton. Labour costs being much higher in the US than in any Latin American country one would expect that organic cotton production would be greater in Latin America than in the US. However, organic cotton output in the season 2016/17 has been 11,9 times larger in the US than it was in Latin America.